cayman islands tax residency

Through the Cayman Islands Golden Visa you could potentially lower your annual. Web Individual - Residence Last reviewed - 04 August 2022 The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily.

Web For information on how American and United Kingdom nationals who now live in the Cayman Islands are taxed by their home countries please read on.

. Web In the Cayman Islands there is no income tax company tax or property tax. Web Corporate - Corporate residence Last reviewed - 04 August 2022 Since no corporate income capital gains payroll or other direct taxes are currently imposed on. Web Any person who has been legally and ordinarily resident in the Cayman Islands for at least eight years but not more than nine years other than the holder of a.

Web When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your. Web The Department for International Tax Cooperation is a department in the Ministry of Financial Services and Commerce. Web The Cayman Islands is a tax haven for those willing to invest to get a residency by investment visa.

However there are import duties that are supposed to be paid ranging from 22 to 27. Web Cayman Islands For the purposes of the Common Reporting Standard CRS all matters in connection with residence are determined in accordance with the CRS and its. Web The Cayman Islands Residency-by-Investment program is revered for the fact that it allows tax-efficient residence and also offers a path to naturalisation and eventual citizenship.

Web Minister addresses immigration backlog. CMR There is no moratorium in effect on the granting of. It is responsible for administering all of the Cayman.

The requirements and benefits will impress you. Web Living Tax Free in the Cayman Islands with their Wealth Residency by Investment Programs. Web Once you obtain a Cayman Islands tax residency you will benefit from the countrys tax-neutral jurisdiction as there is no property income corporate capital gains inheritance.

Web Therefore corporate residency is also not relevant in this regard. Web When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your.

Actions Required On Register Of Beneficial Ownership For Cayman Companies Vistra

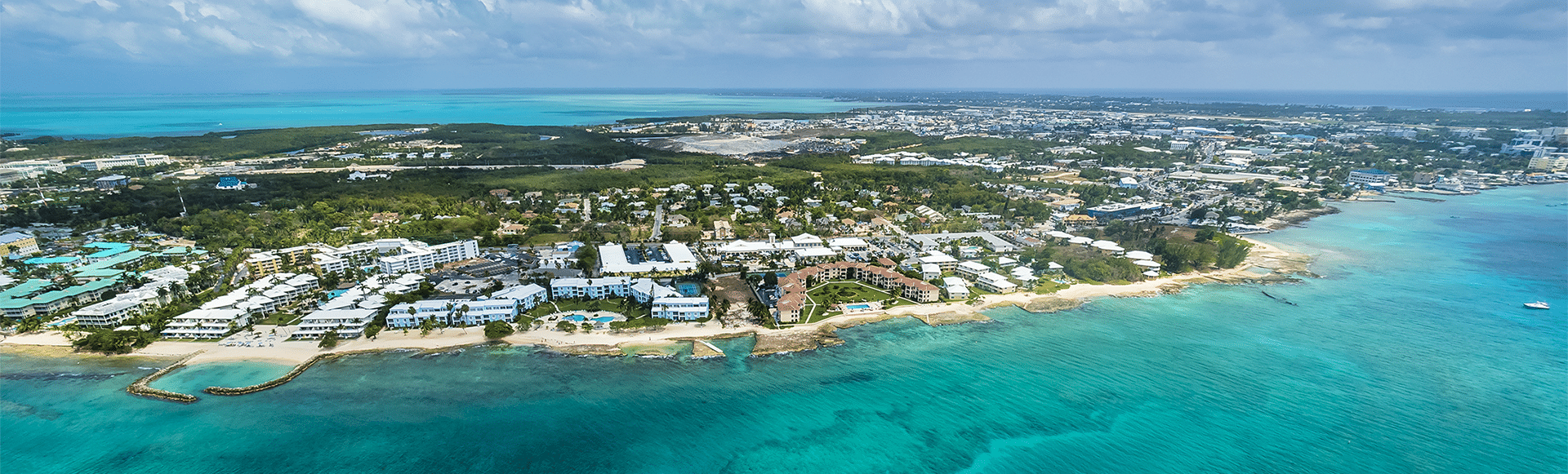

Cayman Resident 2021 By Acorn Media Issuu

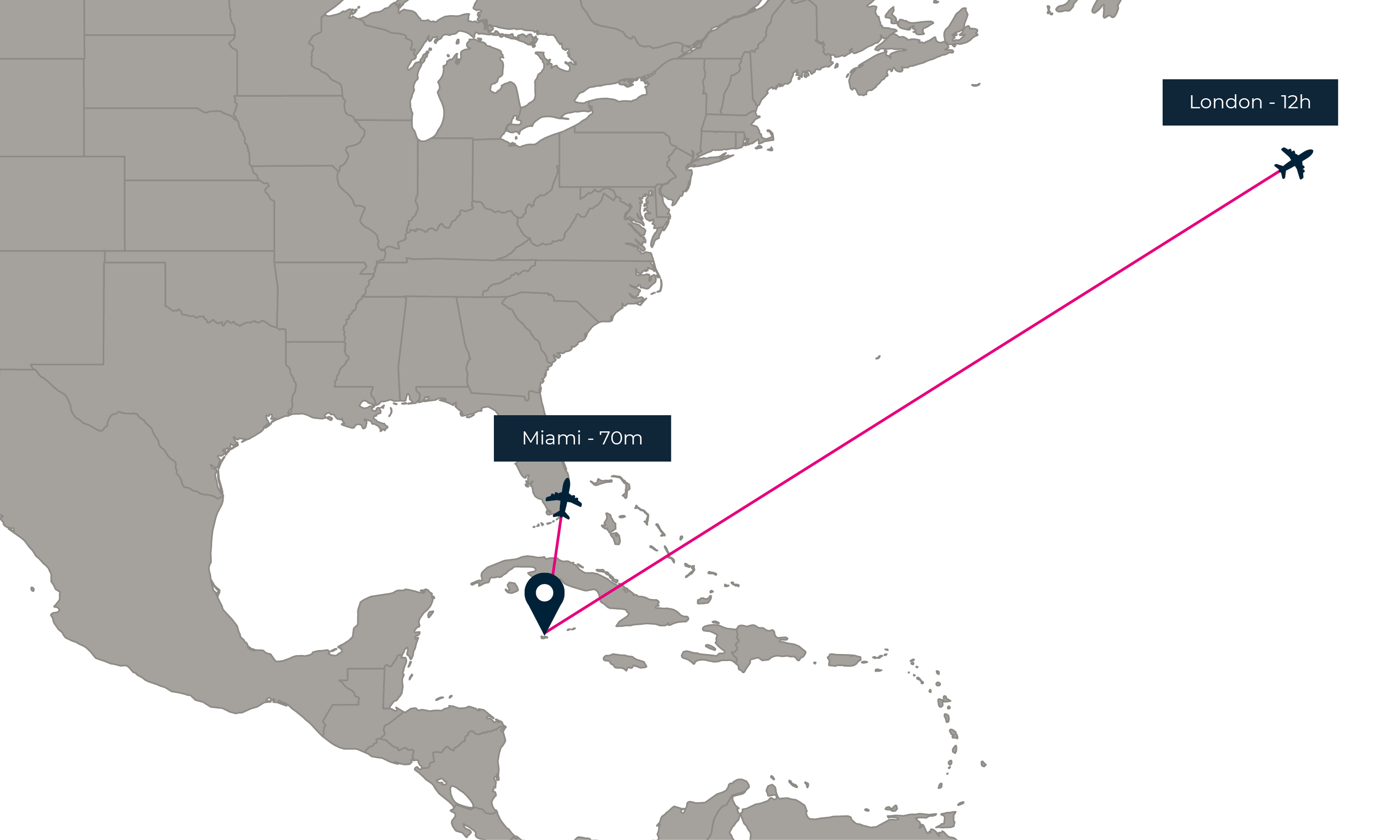

Becoming A Cayman Resident The Cayman Islands

How To Move Your Business To Cayman And Pay No Tax Escape Artist

Caymanian Status Fill Out Sign Online Dochub

The Cayman Islands Residency By Investment Programme Latitude

What To Know About Investing In Cayman Islands Property The Lx Collection

Top 10 Pure Tax Havens Best Citizenships

Advantages Of Residency By Investment In The Cayman Islands Investment Migration Insider

Caribbean Journal How And Why To Retire In The Cayman Islands

How Does Permanent Residency Work In The Cayman Islands

Cayman Islands Residency By Investment Tax Efficient Residency

Us Expat Taxes For Americans Living In The Cayman Islands

Cayman Islands Golden Visa Best Citizenships

Follow The Money Inside The World S Tax Havens Tax Avoidance The Guardian

Tax Free Havens Cayman Islands Tax Rates 0

Cayman Islands Residency Jhmarlin

Cayman Company And Bank Account Online Benefits And Interest Rates